WILMINGTON, Del., Feb 11 (Reuters) - A holder of Six Flags preferred shares asked a federal judge to appoint a trustee to run the bankrupt theme park operator because current management has breached its fiduciary duty and suffers conflicts of interest.

According to a court document filed on Thursday by Resilient Capital Management, Six Flags' (SIXFQ.OB) management did not explore opportunities to pay off preferred securities which could have avoided bankruptcy.

Resilient also said members of the board have drained Six Flags' resources to benefit other companies in which board members have an interest. It also said management was conflicted by the "windfall" it stood to receive upon emerging from bankruptcy.

"There can be no confidence in the current management of the debtors based upon evidence of its own self-dealing and the decisions it made that led debtors into bankruptcy," said the filing.

Resilient holds about $29 million of preferred shares known as PIERS and $1 million of convertible notes.

The court filing said a trustee was needed to investigate Six Flags' relationship with its senior lenders and Holihan Lokey Howard & Zukin Capital, the investment bank that estimated the company's value when it filed for bankruptcy.

Six Flags sought court protection in June with a plan that was far more generous to secured lenders than what the company had proposed in pre-bankruptcy talks. It argued at the time that the company was not worth enough to provide a larger recovery to bondholders, who were nearly wiped out.

In November, the company switched course and adopted a plan proposed by a group of holders of senior bonds, who were led by Avenue Capital Management, a hedge fund.

The Avenue Capital plan proposed selling new stock and new debt financing to pay secured lenders in full, leaving the company in control of the senior bondholders.

Hearings have been scheduled for March to approve that plan, which is opposed by junior creditors and Resilient.

The Avenue Capital plan proposes wiping out Resilient and other holders of the company's preferred and common shares.

Resilient's request said a trustee was needed because of conflicts among members of the board.

It cited Six Flags' purchase of a minority stake in Dick Clark Productions prior to filing for bankruptcy.

Red Zone, a company controlled by Six Flags Chairman Dan Snyder, owns the majority of Dick Clark Productions, and Resilient said Six Flags struck a number of licensing deals with Red Zone for the benefit of Snyder.

"Rather than focusing on debtors' business, debtors' management turned its attention to Red Zone-related entities and treated Six Flags as a marketing catapult for Red Zone investments," said the court document.

Resilient said that if the court rejects the trustee request, it should appoint an examiner with broad powers to investigate the acquisition of Dick Clark Productions, the relationship with secured lenders and the events surrounding management's decision to file for bankruptcy.

The case is In re: Premier International Holdings Inc, U.S. Bankruptcy Court, District of Delaware, No. 09-12019.

Board index ‹ Theme Park Discussions ‹ General Theme Park Discussions ‹ Shareholder wants Six Flags' management replaced

![test [lol]](https://www.coastercrazy.com/forums/images/smilies/icon_e_ugeek.gif) Why Six Flags is associated with a TV Firm i have no clue.

Why Six Flags is associated with a TV Firm i have no clue.

But YAY for corruption reform.

Shareholder wants Six Flags' management replaced

13 posts

• Page 1 of 1

I'll be happy to be the trustee. ![test [lol]](https://www.coastercrazy.com/forums/images/smilies/icon_e_ugeek.gif)

But YAY for corruption reform.

Source?

Support Us! - Click Here To Donate $5 Monthly!

Paradox wrote:

No need to tell Oscar about the problems. He is magic.

God.

Boulder Dash was the only good roller coaster.

"or if you're when the hydraulic fluid was dumped out of the motor is goes 200ft up the tower and is like "LOL nope"" - CKMWM 2016

"or if you're when the hydraulic fluid was dumped out of the motor is goes 200ft up the tower and is like "LOL nope"" - CKMWM 2016

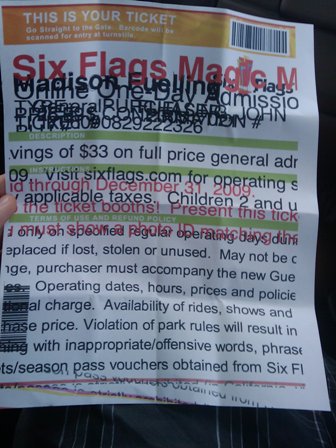

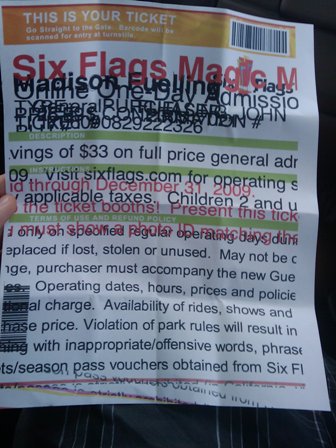

Proof that Six Flags is retarded..

Image Insert:

56.22 KB

Image Insert:

56.22 KB

that looks like a printer error!

Support Us! - Click Here To Donate $5 Monthly!

Paradox wrote:

No need to tell Oscar about the problems. He is magic.

Nawwwww.

Looks like Mr Six was puffin that magic dragon again.

Resilient Objection to Six Flags Bankruptcy

http://www.scribd.com/doc/26790995/Resi ... Bankruptcy

The court document is quite a read, I think its safe to say that Six Flags just got owned. All I can say is it's about love time.

http://www.scribd.com/doc/26790995/Resi ... Bankruptcy

The court document is quite a read, I think its safe to say that Six Flags just got owned. All I can say is it's about love time.

YAY now maybe they will have to change bizarro back to superman because the cost of running it as bizarro is to high!

(yeah i know it will never happen)

(yeah i know it will never happen)

They will probably be forced to tear Superman down in a few years due to corrosion.

13 posts

• Page 1 of 1

Return to General Theme Park Discussions

-

- Related topics

- Replies

- Views

- Last post

-

- BREAKING NEWS: Mark Shapiro Replaced

1, 2by coasterpimp » May 12th, 2010, 4:32 pm - 48 Replies

- 4517 Views

- Last post by Mikey

May 19th, 2010, 2:09 pm

- BREAKING NEWS: Mark Shapiro Replaced

-

- IAAPA announces management transition

by News Bot » June 26th, 2012, 4:00 pm - 0 Replies

- 719 Views

- Last post by News Bot

June 26th, 2012, 4:00 pm

- IAAPA announces management transition

-

- Ellis and Harhi Attraction Management name new president

by News Bot » February 19th, 2013, 2:00 pm - 0 Replies

- 818 Views

- Last post by News Bot

February 19th, 2013, 2:00 pm

- Ellis and Harhi Attraction Management name new president

-

- Apollo Management is not buying Cedar Fair Parks!

by InversionFreak » April 17th, 2010, 8:20 pm - 2 Replies

- 1171 Views

- Last post by slosprint

April 17th, 2010, 8:25 pm

- Apollo Management is not buying Cedar Fair Parks!

-

- six flags astroworld

by 38801xlr8 » July 2nd, 2003, 3:13 pm - 0 Replies

- 864 Views

- Last post by 38801xlr8

July 2nd, 2003, 3:13 pm

- six flags astroworld